Frontier Group Holdings agreed to buy Spirit Airlines for $2.9 billion in cash and stock in a deal that would create a discount airline juggernaut.

Frontier Airlines and Spirit Airlines, the two largest low-cost carriers in the U.S. have agreed to merge, creating what would become the fifth-largest airline in the country. The boards of both companies approved the deal over the weekend, prior to the CEOs of both airlines announcing the agreement in New York City.

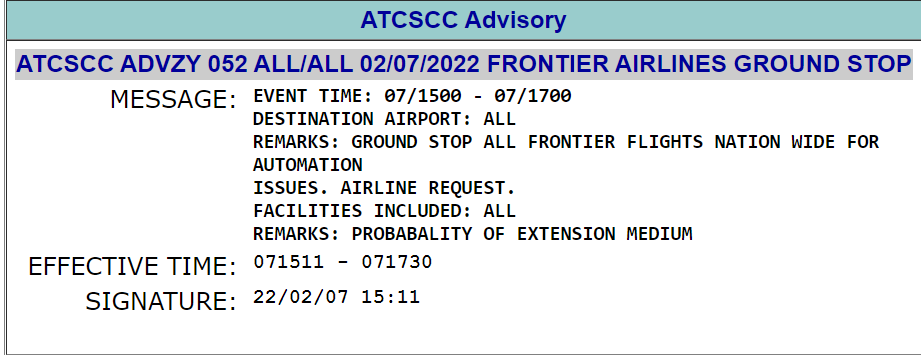

- UPDATE Frontier flights are resuming after the airline suffered IT issues.

- UPDATE Very bad timing, after Frontier announced merging with Spirit, the airline’s flights are grounded nation wide due to IT issues.

- UPDATE Frontier flights are grounded due to an IT problem at the Operations Center.

The deal, valued at $6.6 billion, is structured with Frontier Airlines controlling 51.5 percent of the merged airline while Spirit will hold the remaining 48.5 percent.

Still to be determined is the name of the combined carrier, who will be CEO, and the location of the airline’s headquarters. The chair of the new airline will be Bill Franke, who is the current chair of Frontier and managing partner of its parent company Indigo Partners. In a release announcing the agreement, Franke said the combined carrier “will create America’s most competitive ultra-low fare airline for the benefit of consumers.”

Since that acquisition, Denver-based Frontier has steadily expanded its route network with new destinations and additional flights, often targeting cities where larger airlines like Southwest have a strong presence. In almost every case, Frontier enters with low fares to gain a foothold with travelers seeking lower-cost tickets.